The Pros and Cons of Renting Versus Buying a Home

Should You Rent or Buy a Home?

Easy To Move On

No Property Taxes

For many homeowners, property taxes are the 2nd highest cost of owning a home, next to their mortgage payment. Home owners insurance is a close 3rd for expenses, which is another fee that you do not have to pay when you rent a home...or do you? I have heard the argument that the cost of property insurance and home owners taxes are enough to make people rent, rather than buy. But think about this, the landlord of the property that you rent is also paying property taxes and insurance. So, who is really paying the property tax and insurance? It just makes sense that the cost of the tax and insurance are being passed on to the tenant. This means that tenants are inadvertently paying the taxes and insurance for their landlord, just not directly. There are also tax advantages to owning a home as well.

No Maintenance

You Can Make It Yours

No Payment Hikes

Build Equity

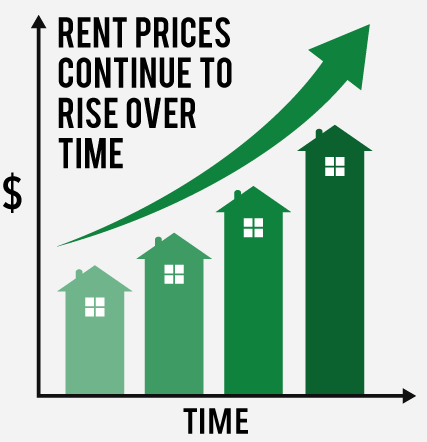

Increasing Rents

Lease Deadline

No Equity

Need Money For Down Payment

The Cost of Selling

Homeowner Responsibilities

Both renting and buying have their advantages and disadvantages. It really comes down to the stability of your living situation. If you have a career that is moving forward and you feel like you are going to be in your current city for a while, buying a home makes much more sense. If your life is up in the air and you don't know what next year is going to be like, renting a home makes a lot more sense. Buying a home costs less in the long run and builds your financial situation. Renting a home is expensive and always leaves you without any true ownership or equity.

Taking time to truly look at all of each option can help you plan your life to move in the direction that benefits you the most. If you plan on buying a home, there is a ton of information online to help you. Start with this article that explains how to buy your first house. It will give you a quick overview of the home buying process and help you identify where to start. Good luck and happy hunting!

Popular Articles