How To Buy A House: A Step By Step Guide

Posted by Winston Bowdre

This step-by-step guide will walk you through each step of the home buying process. Use it as a reference and remember to ask your REALTOR® anytime you have questions. Your REALTOR® will help you through each step.

The home buying process can be an intense journey, but it's much easier when you have a clear path and realistic expectations. This guide is designed to help you through the process. Let's get started!

Preparing your finances is the very first step in buying a home. This will allow you to find the price range that fits your budget before you start looking at homes. If you begin your home search in a higher price range than you are approved for, you are setting yourself up for disappointment. Start preparing your finances right from the start and you'll be ready for the next step. Here are 5 important tips to help you through the home financing process.

Know Your Credit History

Calculate Your Debt-to-Income

Gather Your Tax, Financial, & Employment Documents

Find A Mortgage Lender

Complete Your Loan Pre-Approval

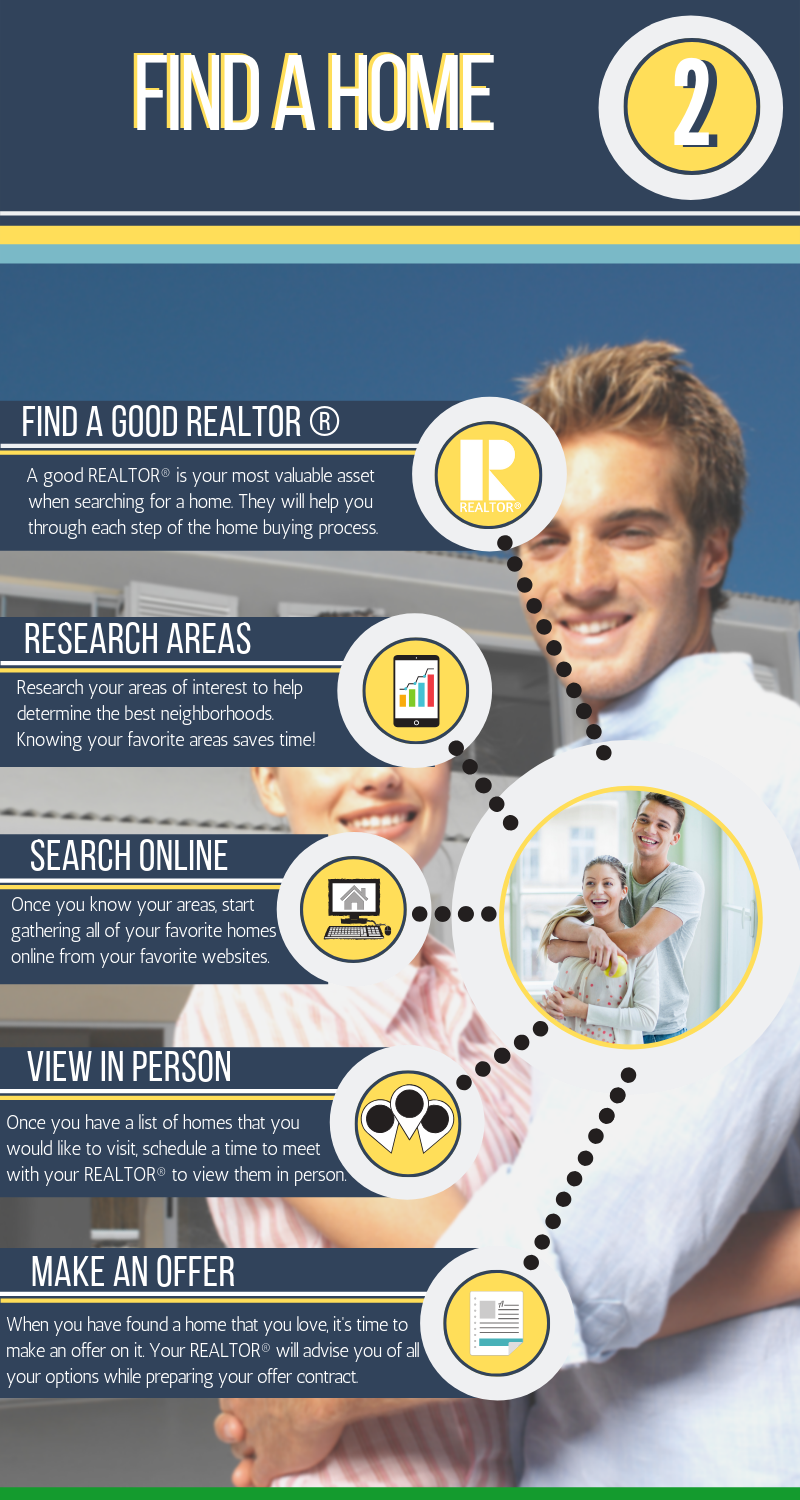

Find A Good REALTOR ®

Research Local Areas

Search For Homes Online

Visit Homes In Person

Make An Offer

Now that you have prepared your finances and found a home, it's time to close the transaction and get the keys! These items need to be handled in a timely manner. Your REALTOR® will help guide you through each step. You can use this section as a reference as you are moving through the final steps of buying your new home.

Negotiate The Transaction Terms

Deposit Earnest Money

Perform Inspections

Perform Appraisal

The appraisal is one of the last steps in the home buying process. Mortgage companies require appraisals to verify that the loan amount they are providing is equal to, or better than the appraised value of the home. It's protection for the lender. If the house does not appraise at value, then the contract will either be terminated or renegotiated. Be sure to have the appraisal ordered as soon as your inspections are complete. Delayed appraisals are one of the main causes of late closings.

Close The Transaction

Once you are past the inspections and appraisal process, you can set up a closing time with the title company and the other party. Be sure to bring your driver's license (or passport) to closing, along with any monetary items required by the sales contract and/or lender. Once both parties have signed all of the documents and the mortgage company has funded the loan, you will get the keys. You are now the proud owner of your new home. Congratulations!

The home buying process can seem intimidating and complicated, but working with a good REALTOR® makes the process very easy. Your REALTOR® will keep you on track and make sure that every step of the process is handled correctly and in a timely manner. Happy house hunting!

Hey There! I'm the owner and broker of Winston Alan Realty and creator of most of the content on my website. Thanks for taking the time to read this article. Please feel free to leave a comment in the message box below, or to share this article on social media with someone who might benefit from it. I appreciate your time here on this website and I am always open to suggestions and ideas from our readers. Feel free to contact me anythime at [email protected].